Virtual - Hosted Payment Pages

This is a popular solution mainly due to the ease of integration into the solution and the high level of Security that it provides to merchants.

Introduction to Virtual

The Virtual Payment Solution makes use of Adumo Online's hosted payment page. This is a popular solution mainly due to the ease of integration into the solution and the high level of Security that it provides to merchants.

The Virtual Solution also has the ability to be customized to such an extent that your client would feel as though they are on your website while making payment, ensuring peace-of-mind throughout the entire checkout process.

The Virtual solution offers the ability for a merchant to customise the logo, colours and details displayed on the payment page so that the cardholder does not feel that they are leaving the merchants website. The Virtual Payment Page is operating behind TLS (Transport Layer Security) security protocol and all information that is captured on the payment page is encrypted using 128-bit encryption ensuring that your client's credit card details are kept safe.

Virtual Features

- The merchant is not required to implement TLS, therefore saving costs.

- Both the merchants logo and details can be hosted on the payment page.

- CSS Editor allowing full payment page customization.

- Email confirmation can be sent to card holder for successful purchases.

- The Fraud Module can be configured to help reduce fraud.

- Failure and Success Pages can be configured to be displayed by Adumo Online.

- Additional detail such as shipping address and purchase items can be displayed on the payment page

- This is a quick and easy method which ensures less programming.

- Basic development skills are required.

Virtual Payment Process

One of the main benefits of utilising the Virtual Solution is the simplicity in which to integrate it into your online website. It requires less development work than other Adumo Online Solutions and security measures are already incorporated by Adumo Online.

Virtual allows the merchant to utilize the Adumo Online payment webpage. This means that your clients will be directed to Adumo Online's Payment Page where they will enter their credit card details in order for the transaction to be completed. The payment information which Adumo Online requires is posted to Adumo Online via a form POST. This POST can be done in any language that supports this method.

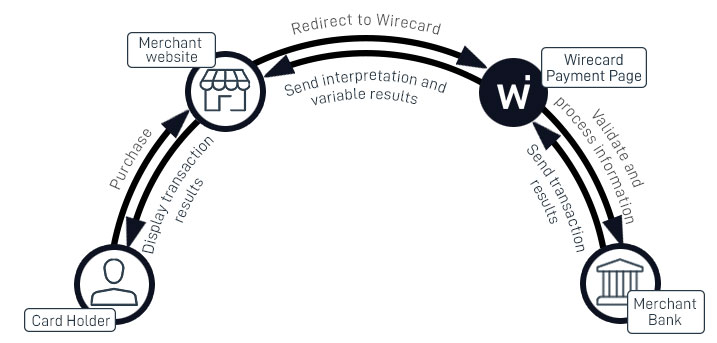

Illustration: Virtual Payment Process

Step 1 – Cardholder makes purchase from merchant's website.

Step 2 – Merchant creates form post to Virtual payment page.

Step 3 – Adumo Online processes the transaction to the merchant Bank.

Step 4 – The merchant bank processes the transaction and returns a successful or declined message.

Step 5 – Adumo Online returns this result and/or error code with error description back to the Merchant

Website address specified in the form POST.

Step 6 – If the functionality is set up (from the Adumo Online Web Console) Adumo Online will notify the card

holder via email of the transaction details and the merchant via email.

General Requirements for Using Virtual

- Website – You must have a website or shopping cart and have ability to load sample code or shopping cart code to the site.

- Internet Merchant Account – You are required to have an internet merchant account with a bank.

- Internet Connectivity – Internet connectivity is required to post the transaction.

- Internet Service Provider (ISP) – An ISP is required to host your site.

- Adumo Online issued Merchant ID and Application ID – Required parameters when sending your form post.

Internet Merchant Account

An Internet Merchant Account is required to accept credit card transactions over the internet. If you have an Internet Merchant Account you need to supply these details to Adumo Online before going Live. If you do not have an Internet Merchant Account, Adumo Online can assist you with your application to the acquirer (bank).

Note: An Internet Merchant Account is a different type of merchant account than what is used for card present / POS transactions. You will need to apply for an Internet Merchant Account even if you already accept credit card transactions from your store.

Security – Server Passwords

You need to apply security best business practice to ensure that confidential data and card detail are protected while either being stored in the database or while data is being transmitted. It is suggested that you encrypt key information issued to you by Adumo Online. This will be things like your User Access, JWT Token Secret and access tokens.

Note: To reduce fraud or potential incidents it is recommended to encrypt any passwords that give access to your server.

TLS

TLS (Transport Layer Security) is a security protocol that ensures that data being captured on Adumo Online's payment page cannot be read by encrypting the data using two encryption keys. The Virtual solution does not require a merchant to implement TLS protocol as this is handled by Adumo Online.

Integration

Form Post URL

The form post URL is the Adumo Online URL used to submit the form post to. Adumo Online provides the following URL for both Live and Test.

Test URL : https://staging-apiv3.adumoonline.com/product/payment/v1/initialisevirtualCopy URL to clipboard

Production URL : https://apiv3.adumoonline.com/product/payment/v1/initialisevirtualCopy URL to clipboard

Testing

View all ApplicationUIDsFor testing purposes, we have provided a MerchantUID and ApplicationUID's in multiple currencies.

MerchantID: 9BA5008C-08EE-4286-A349-54AF91A621B0

JWT Secret: yglTxLCSMm7PEsfaMszAKf2LSRvM2qVW

3D Secure OTP/Password: Displayed on the ACS Page, otherwise try: '1234' or 'test123'

When going live, these will need to be replaced in your code by using the Adumo Online issued MerchantID and ApplicationID. You can retrieve your JWT Secret from the Merchant Portal.

Test Cards

Test Cards are used to perform test authorizations to Adumo Online. Test Cards will only work when using the test URL. Test Cards transactions will not go to the acquirer.

Test Card Types

- Visa

- MasterCard

- Amex

- Diner

- Maestro

Note: Test Cards will only work when posting to the test URL and specified ApplicationUID. Using a test card with an application other than the one it is listed with, will produce inconsistent results (e.g. Using a 3D Secure test card on the Non3D Secure application).

Note: The Frictionless cards are fully 3D Secure, but they do not display an ACS Page for the customer to complete

3D Secure Test Cards (Application: 23ADADC0-DA2D-4DAC-A128-4845A5D71293)

| Visa Successful | |

| Card Name | Joe Soap |

| Card Number | 4000000000001091 |

| Card Type | Visa |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| Visa Failed | |

| Card Name | Joe Soap |

| Card Number | 4000000000001109 |

| Card Type | Visa |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| MasterCard Successful | |

| Card Name | Joe Soap |

| Card Number | 5200000000001096 |

| Card Type | MasterCard |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| MasterCard Failed | |

| Card Name | Joe Soap |

| Card Number | 5200000000001104 |

| Card Type | MasterCard |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

Frictionless 3D Secure Test Cards (Application: 23ADADC0-DA2D-4DAC-A128-4845A5D71293)

| Visa Successful | |

| Card Name | Joe Soap |

| Card Number | 4000000000001000 |

| Card Type | Visa |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| Visa Failed | |

| Card Name | Joe Soap |

| Card Number | 4000000000001018 |

| Card Type | Visa |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| MasterCard Successful | |

| Card Name | Joe Soap |

| Card Number | 5200000000001005 |

| Card Type | MasterCard |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| MasterCard Failed | |

| Card Name | Joe Soap |

| Card Number | 5200000000001013 |

| Card Type | MasterCard |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

Non 3D Secure Test Cards (Application: 904A34AF-0CE9-42B1-9C98-B69E6329D154)

| Visa Successful | |

| Card Name | Joe Soap |

| Card Number | 4111111111111111 |

| Card Type | Visa |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| Visa Declined | |

| Card Name | Joe Soap |

| Card Number | 4242424242424242 |

| Card Type | Visa |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| MasterCard Successful | |

| Card Name | Joe Soap |

| Card Number | 5100080000000000 |

| Card Type | MasterCard |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| MasterCard Declined | |

| Card Name | Joe Soap |

| Card Number | 5404000000000001 |

| Card Type | MasterCard |

| Expiry Date | Any date in future |

| CVV Number (last 3 digits on back of card) | any cvv |

| Amex Successful | |

| Card Name | Joe Soap |

| Card Number | 370000200000000 |

| Card Type | AMEX |

| Expiry Date | Any date in future |

| CVV Number(last 3 digits on back of card) | any cvv |

| Amex Declined | |

| Card Name | Joe Soap |

| Card Number | 374200000000004 |

| Card Type | AMEX |

| Expiry Date | Any date in future |

| CVV Number(last 3 digits on back of card) | any cvv |

| Diners Successful | |

| Card Name | Joe Soap |

| Card Number | 36135005437019 |

| Card Type | Diners |

| Expiry Date | Any date in future |

| CVV Number(last 3 digits on back of card) | any cvv |

| Diners Declined | |

| Card Name | Joe Soap |

| Card Number | 36135182434011 |

| Card Type | Diners |

| Expiry Date | Any date in future |

| CVV Number(last 3 digits on back of card) | any cvv |

| Maestro Successful | |

| Card Name | Joe Soap |

| Card Number | 5641821111166669 |

| Card Type | Maestro |

| Expiry Date | Any date in future |

| CVV Number(last 3 digits on back of card) | any cvv |

| Maestro Declined | |

| Card Name | Joe Soap |

| Card Number | 6759411100000008 |

| Card Type | Maestro |

| Expiry Date | Any date in future |

| CVV Number(last 3 digits on back of card) | any cvv |

Test CVV

As additional account security, every credit card comes with a special three or four digit code generally known as a CVV2 or CVV number. Cardholders will be requested to enter this when processing an online payment. An identity thief who has come across credit card information illegally will not have access to the CVV number if they do not have physical access of the card.

Go Live Checklist

Overview

Use the Go Live Check List to make sure that you have completed all necessary tasks before going live. Please ensure that the following criteria have been met:

Configuration

-

Virtual Form Post have been embedded onto your website

-

Merchant Payment Page have been configured in Adumo Online Portal

-

Merchant ID and Application ID of the “Merchant” (NOT test Merchant ID and Application ID) is being used in your message type.

Testing

-

Test a Successful Transaction using our Virtual Test Cards

-

Test a Decline transaction using our Virtual Test Cards

-

Test transactions are visible in Adumo Online Portal

Go Live

-

Merchant received Go Live email from Adumo Online. This email will contain the merchants Customer ID and Merchant ID .

(If not, have merchant contact support@adumoonline.com) -

Ensure that you are using the Live URL.

-

Perform Live transaction with Live card

Integration Support

Merchants

If you are a merchant that has signed up with Adumo Online's Virtual solution, you will have access to Adumo Online's Integration Help Desk for telephonic and email support. Telephonic support is available 8am to 5pm GMT +2. Email support is 8am to 5pm GMT + 2 and connects directly to our help desk through our ticketing system.

Developers

If you are a developer that you will have access to Adumo Online's Integration Help Desk for email support. Email support is 8am to 5pm GMT + 2 and connects directly to our help desk through our ticketing system.

If you send an email you will immediately be emailed back a reference to track your integration query.

Email: support@adumoonline.com

JSON Web Token (JWT)

What is JSON Web Token?

"JSON Web Token (JWT) is an open standard (RFC 7519) that defines a compact and self-contained way for securely transmitting information between parties as a JSON object. This information can be verified and trusted because it is digitally signed."

You can read more here (https://jwt.io/introduction)

You must implement the JSON Web Token (JWT) in the request to us and validate the response token (_RESPONSE_TOKEN)

We strongly recommend the following validation on the response token:

Confirm the signature of the JWT token is valid

Confirm that the values in the JWT token match with the values for the order.

These values must be present and will be validated:

mref (Merchant Reference)

amount

auid (Application UID)

cuid (Merchant UID)

notificationURL - In addition to the above variables, the notificationURL can be used to sent a webhook per transaction in addition to the ones that is configured in the merchant portal. Refer to webhooks: Webhooks

Use the result field in the JWT token as your success and failed indicator

Warning: Failure to put the recommended JTW token validations in place could lead to financial losses.

Example JWT

eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJtdWlkIjoiMzQ4OEJGNzItMDFFNi00REU1LUI2NjAtMUZFQTdGOUE0Q0NBIiwiY3VpZCI6IjM0ODhCRjcyLTAxRTYtNERFNS1CNjYwLTFGRUE3RjlBNENDQSIsImp0aSI6IjUyMjViZmQ1NDExMWFzZGNhM2EiLCJpYXQiOjE1NTI5MTMzOTgsImV4cCI6MTU1Mzk5OTc5OH0.d8uEgDew3SiUxpe-Kyp3NqZJgJo75FlRN5G3AXohk5Y

Request Example

{

"iss": "Dev Center",

"cuid": "9BA5008C-08EE-4286-A349-54AF91A621B0",

"auid": "4196B0B8-DB88-42E5-A06D-294A5E4DED87",

"amount": "12.00",

"mref": "DEV_xUQ58CeG",

"jti": "QXiY24ZQvuPkwvU6KlDokWIgeX387MlX+M3qF8OrhRY=",

"iat": 1621936758,

"exp": 1621937358,

"notificationURL":"https://webhooks.yourdomain.com/webhooks/response.php"

} Decoded Response Example

{

"jti": "[B@51c83aae",

"iat": 1612528158,

"cuid": "BAAB2819-7286-49D3-8AD3-1212B3B40C2A",

"auid": "A50376D2-0CDF-46DF-BDDD-30F0B514D853",

"result": -1,

"transactionIndex": "5bb926df-68ed-4154-bf01-cd1e7f2278a5",

"mref": "DV_LNMnOi8bUn",

"amount": "0.02",

"mode": "1",

"tkn": "",

"puid": "e36bdd6e-c9c1-4aa6-a10d-8f0ce9b6d361",

"exp": 1612528758

} JWT(Token field) can be programatically constructed as follows:

php Example using a standalone php library

require_once('jwt.php');

$SecretKey = 'NFeCMY17FoaDkLe3azMchsNbLOpgkO2Wh58'; //Supplied by Adumo Online

$payloadArray = array();

$payloadArray['iss'] = $iss; //The identity of the party that issued the JWT. The claim holds a simple string, of which the value is at the discretion of the issuer

$payloadArray['cuid'] = $MerchantID;

$payloadArray['auid'] = $ApplicationID;

$payloadArray['amount'] = $amount;

$payloadArray['mref'] = $merchantReference;

$payloadArray['jti'] = base64_encode(random_bytes (32));

$payloadArray['iat'] = time() - 60;

$payloadArray['exp'] = time() + 600;

$payloadArray['notificationURL'] = 'https://developers.adumoonline.com/webhooks/response.php';

//$Token will be used to populate the Token form field in the POST to our payment page

$Token = JWT::encode($payloadArray, $SecretKey);

//The response token can be decoded as follows

$decodedData = JWT::decode($jwtToken, $SecretKey, array('HS256')); You can download the above sample code here (Virtual Example with JWT.zip)

You can find more code examples here (https://jwt.io/#libraries-io)

HTML Code

If you have in‐depth HTML knowledge or web development skills you can create more variables. The below examples could be applied if you have a web application or shopping cart. The Below HTML example shows how your form POST could look when extensive information is getting sent to Adumo Online:

Virtual Request and Response Format

This section provides detailed documentation of the request and response parameters used in Virtual payment transactions. Understanding these parameters is essential for proper integration with the Adumo Online Virtual payment system.

Virtual Request Layout

The following table describes the request parameters that can be sent to the Virtual payment page:

Data Element Name |

Presence |

Field Type & Format |

Description |

Example |

MerchantID |

M |

GUID |

Each merchant is issued a MerchantID from Adumo Online. This will identify the merchant on Adumo Online's Back Office system. |

F5785ECF-1EAE-40A0-9D37-93E2E8A4BAB3 |

ApplicationID |

M |

GUID |

Each merchant is issued with an ApplicationID by Adumo Online. The ApplicationID is linked to your website or application. A merchant can have multiple ApplicationUIDs. The ApplicationID is linked to the MerchantID. |

1DBBBAAE-958E-4346-A27A-6BB5171CEEDC |

MerchantReference |

O |

String (38) |

The merchant can submit a reference per transaction. Typically, the Merchant Reference is an order number or invoice number. Only alphanumeric characters, spaces, underscores and hashes are allowed and must be UTF-8 encoded. |

19102015ordernum14 |

Amount |

M |

Decimal (6.2) |

This is the total value to be processed for authorization to the acquirer. |

150.00 |

Token |

M |

String |

This is the JWT token that is generated for the request. The following fields are mandatory for the token body:

|

eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJzdWIiOiIxMjM0N TY3ODkwIiwibmFtZSI6IkpvaG4gRG9lIiwiaWF0IjoxNTE2MjM5MDI yfQ.SflKxwRJSMeKKF2QT4fwpMeJf36POk6yJV_adQssw5c |

AuthoriseCurrencyCode |

C |

String (3) |

This is the currency that will be collected from the card holder. Its must be a valid ISO4217 3 Character currency. Only Required if MCP is enabled and the collected value must be in the currency specified |

USD |

RedirectSuccessfulURL |

M |

String (255) |

This is the url that Adumo Online will redirect to in the event of a successful transaction. If it is left empty, the shopper will not be redirected and your system will not receive an update |

http://www.yourwebsite.com/success.html |

RedirectFailedURL |

M |

String (255) |

This is the url that Adumo Online will redirect to in the event of a failed transaction. If it is left empty, the shopper will not be redirected and your system will not receive an update |

htttp://www.yourwebsite.com/failed.html |

OrderQty |

O |

String (255) |

This is the total quantity of items purchased. This will be displayed on the payment page. |

2 |

OrderRef |

O |

String (255) |

This allows you to link an order to a reference number in your shopping cart. |

Order number 1234 |

OrderDescription |

O |

String (255) |

This is a description of the order |

Books |

OrderAmount |

O |

Decimal (6.2) |

This is the total order amount in value terms. |

150 |

OrderShippingCost |

O |

Decimal (6.2) |

This is the total orders shipping amount in value terms. |

15.00 |

OrderDiscount |

O |

Decimal (6.2) |

This is the total orders discount amount in value terms. |

25.12 |

Recipient |

O |

String (255) |

The name of the individual who has placed the order on your website or shopping cart. |

Joe Soap |

Shipping Address1 |

O |

String (255) |

This is the first line displayed for the shipping address |

14 Street Name |

Shipping Address2 |

O |

String (255) |

This is the second line displayed for the shipping address |

Somewheresville |

Shipping Address3 |

O |

String (255) |

This is the third line displayed for the shipping address |

Some Province |

Shipping Address4 |

O |

String (255) |

This is the fourth line displayed for the shipping address |

Somewhere Country |

Shipping Address5 |

O |

String (255) |

This is the fifth line displayed for the shipping address |

8001 |

ItemQty |

O |

N(9) |

This is the total quantity of a particular item purchased. |

2 |

ItemRef |

O |

String (255) |

This is used to link a reference to a particular item purchased. |

1285698 |

ItemDescr |

O |

String (255) |

This is the description of the item. |

Books |

ItemAmount |

O |

Decimal (6.2) |

This is the total item amount in value terms. |

150.00 |

ItemShippingCost |

O |

Decimal (6.2) |

This is the item shipping amount in value terms. |

15.00 |

ItemDiscount |

O |

Decimal (6.2) |

This is the total item discount amount in value terms. |

25.12 |

Variable |

O |

String (255) |

This can be used by merchants to post through additional variables. These will be posted to the success and failed pages in addition to the Transaction Result. |

INV454001 |

UCI |

O |

String (128) |

This relates to Adumo Online Fraud Module and is used by the following fraud options: BLS (Blacklisting Service) AND UCI (Unique Client Identifier Service). Please see the online Fraud Module Documentation for details. |

Account123 |

IPAddress |

O |

String(255) |

This relates to Fraud Module and is used by the following fraud products: RSI (Repeated Success Identifier Service), RFI (Repeated Failure Identifier Service), BLS (Blacklisting Service) and GIR (Global IP Recognition Service). Please see the online fraud module documentation for details. |

17.172.224.47 |

ShippingCountryCode |

O |

String (2) |

This relates to the Fraud Module and represents the 2 letter country code of the country to which the item/s are being shipped. This is used by the following fraud products: BLS (Blacklisting Service) and GIR (Global IP Recognition Service). Please see the online Fraud Module Documentation for details. Must be represented by 2 Letters as specified in ISO4217 |

UK |

CountryCode |

O |

String (2) |

This represents the country where the purchaser is. If using the Payment Options Page, this will be used to determine what payment options to display. |

UK |

Virtual Response Layout

The following table describes the response parameters that are returned from the Virtual payment page after a transaction is processed:

Data Element Name |

Presence |

Field Type & Format |

Description |

Example |

|

_RESULT |

M |

Bit |

This is the result from the Authorization Request resulting in either a successful or failed transaction. |

0 = successful |

|

_STATUS |

M |

String (255) |

This is the transaction status indicating the final state of the transaction. |

APPROVED, DECLINED, USER_CANCELLED |

|

_MERCHANTREFERENCE |

M |

String (38) |

This is the merchant reference submitted in the authorization request. |

19102015ordernum14 |

|

_TRANSACTIONINDEX |

M |

GUID |

The transaction index is a unique identifier created by Adumo Online for a specific transaction for tracking and reconciliation purposes. |

7E4FEF88-DAC0-4CAE-B57A-129F3F369B07 |

|

_ERROR_CODE |

C |

N(4) |

This is a Adumo Online Error Code should one be generated. |

1004 |

|

_ERROR_SOURCE |

C |

String (255) |

Validation identifies the process area in which the transaction failed or was declined. |

validate.card details |

|

_ERROR_MESSAGE |

C |

String (255) |

The error message is a brief message relating to the Response Code. |

ApplicationUID is required |

|

_ERROR_DETAIL |

C |

String (255) |

The message detail is a detailed description of the error message. |

An invalid merchant UID was specified. Please check that you have entered the correct merchant id. |

|

_BANK_ERROR_CODE |

C |

N(2) |

This is a Bank Error Code returned by the bank when a transaction is declined. |

21 |

|

_BANK_ERROR_MESSAGE |

C |

String (255) |

This is the message relating to the bank error code. |

Insufficient funds |

|

_3DSTATUS |

C |

N(1) |

This is the Electronic Commerce Indicator provided from the MPI. |

5 |

|

_PANHASHED |

C |

String (16) |

The first six and last 4 digits of the card number used in the transaction. This is only provided if the merchant requests for Adumo Online to send this data element. |

123456******1234 |

|

_CARDCOUNTRY |

C |

String (255) |

This is the county where the card was issued. |

UK |

|

VARIABLE1 |

C |

String (255) |

These are your variables returned if they were specified in the original authorization request post. |

INV454001 |

|

_COUNTRYCODE |

M |

String(3) |

This is the country code that was submitted by the Merchant in the Authorisation Request. |

UK |

|

_CURRENCYCODE |

M |

String(3) |

This is the authorization currency type that the transaction was processed in. |

USD |

|

_AMOUNT |

M |

Decimal (6.2) |

This is the total value processed. |

150.00 |

|

_PAYMETHOD |

M |

String (255) |

This is a brief message outlining the payment method used. |

ePay Virtual , SID, Mobicred, Visa Checkout |

|

_ACQUIRERDATETIME |

M |

YYYY/MM/DD hh:mm:ss |

This is the time and date stamp that the transaction was processed. |

ePay Virtual , SID, Mobicred, Visa Checkout |

2007/05/15 11:42:10 AM |

_RESPONSE_TOKEN |

M |

String |

This is the JWT response token containing transaction details that should be validated by the merchant. |

eyJhbGciOiJIUzI1NiJ9.eyJqdGkiOiJbQkA1ZjJh... |

|

_LOCALE |

C |

String (5) |

This is the locale/language setting used for the transaction. |

en_ZA, en_US |

|

TXTPRICE |

C |

Decimal (6.2) |

This is the transaction price/amount processed. |

0.02 |

|

VARIABLE1 |

C |

String (255) |

This is the first custom variable returned if specified in the original authorization request. |

Testing123 |

|

puid |

C |

GUID |

This is the Profile Unique Identifier used for tokenization and 1Click payments. |

e36bdd6e-c9c1-4aa6-a10d-120e36bdd6e2 |

|

uci |

C |

String (128) |

This is the Unique Client Identifier returned if specified in the original authorization request, used for fraud detection. |

Account123 |

HTML Sample

The below code can be copied into your code for testing purposes. Please note however, that before going live, you will need to change the details in the above example.

Payment Methods

Overview

Merchants can use Virtual to integrate with any of Adumo Online's payment methods. The payment methods that Adumo Online offer can be found at https://www.adumoonline.com/solutions

Examples of these payment methods are:

- Credit Card & Debit Card

- SecureEFT

- Visa Checkout

- Mobicred

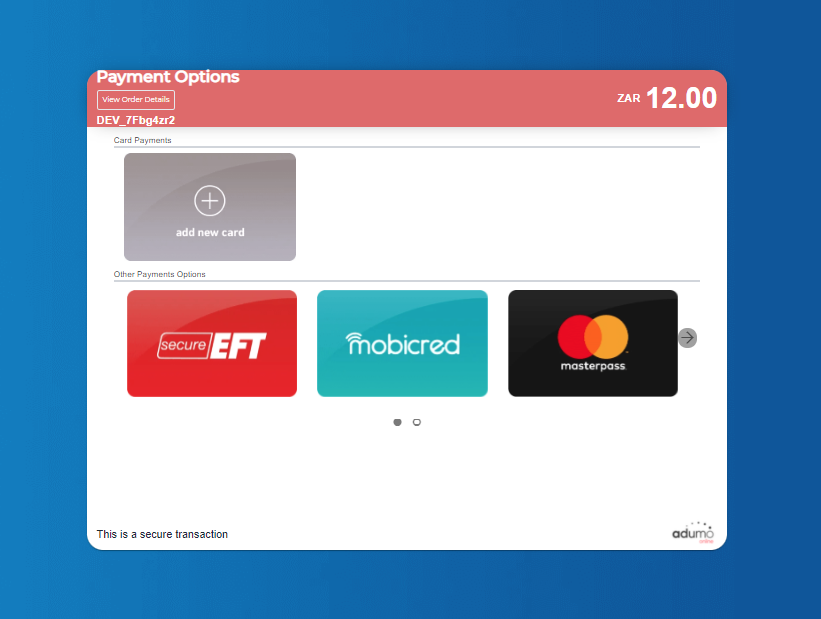

Payment Options Page

Process Flow Description for Payment Page

- The merchant begins the process by posting a ‘Request’ to Virtual.

- All the payment methods linked to the application ID used will display in the payment options menu.

- Virtual processes the transaction to the relevant financial service provider.

- Virtual replies immediately by posting back detailed ‘Response’ data. The detailed response will include the payment method that was used to pay.

- In some cases, the payment method chosen will be more suited to an ‘asynchronous’ process. For instance, when the client is given payment instructions by Virtual and these instructions can take some time to complete. If/when Virtual receives a response from the financial service provider, then Virtual will post the ‘Response’ data back to the RedirectSuccessfulURL or RedirectFailedURL provided by the merchant in step 1.

Example of Payment Options Page

Payment Option Page Customization

The payment options page is customizable (example: merchant logo) to maintain the look and feel of the merchant system as far as possible. This is done from within the Adumo Online Web Console. Click here to see how to upload logo.

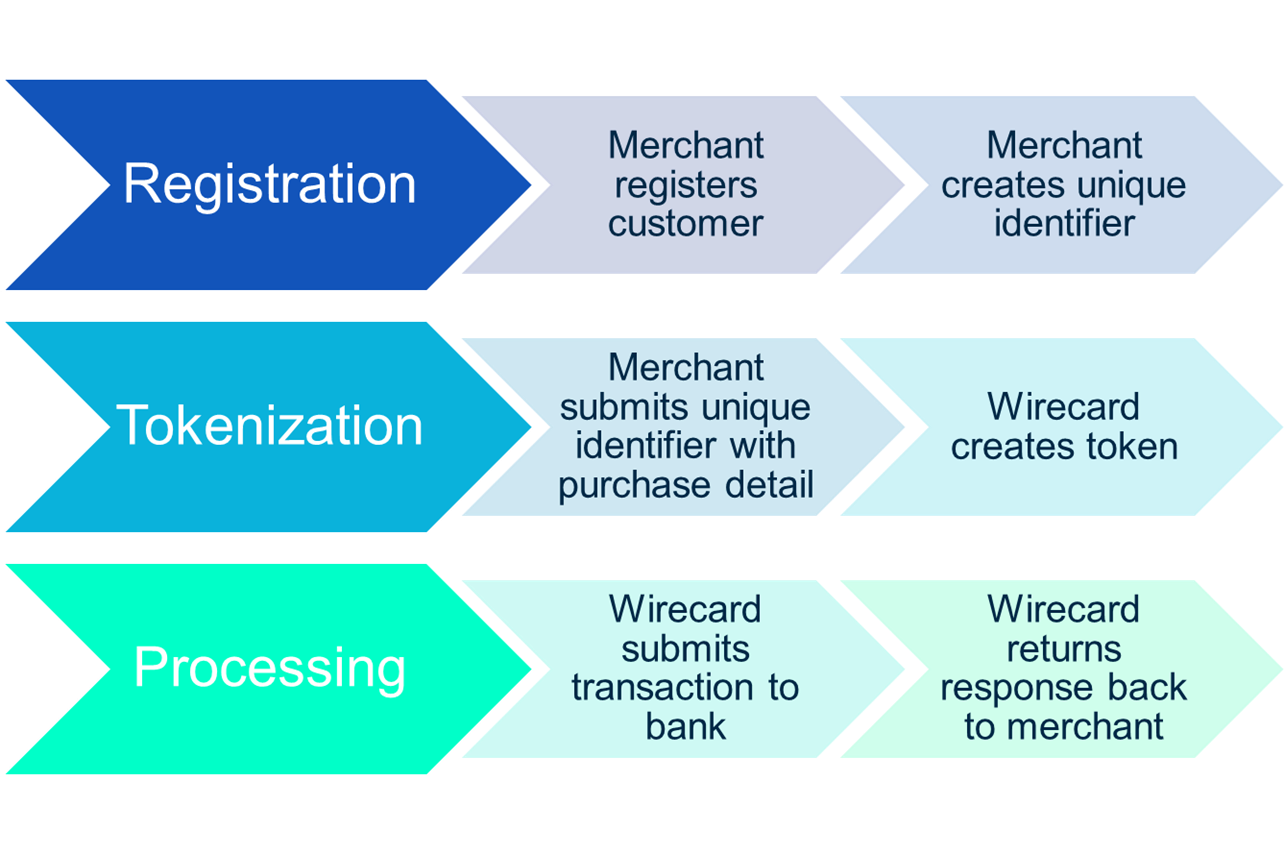

Virtual 1Click

Introduction to 1Click

1Click payments offers the card holder a simplified checkout experience. The solution caters for customers that repeatedly purchase goods or services from a merchant’s website by simplifying the checkout experience. The solution will tokenize the card holder’s details during the initial transaction. For subsequent transactions, the merchant can be configured to allow the cardholder to enter a CVV or not, to process the payment, making the checkout process more simplified. At any point, the card holder can amend card details, which will update the token with the new card information.

For the Virtual 1Click solution, it is possible to store multiple cards, allowing the user the ability to choose the tokenized card they wish to pay with.

1Click Payment Process

One of the main benefits of utilising the 1Click - Virtual Solution is the simplicity in which to integrate it into your online website. It requires less development work than other Adumo Online Solutions and security measures are already incorporated by Adumo Online.

1Click Process Flow

1) Submit a form POST to the Virtual payment page and include an additional form field in your request <input type = "hidden" name = "puid" value = "3488BF72-01E6-4DE5-B660-1FEA7F9A4CCA">

2) The payment page reads the puid field and does a lookup to see if the token has been registered before:

3) If card detail is not registered yet (Card holders first time making a payment):

- The card holder is required to enter full card details and select "Save and Pay Now".

- Adumo Online takes the card details with the token submitted in the form POST and registers the details in the Adumo Online's database.

- The transaction is then processed as normal to the bank.

- The transaction results are returned in the message response.

- The PUID is the Profile ID that all tokenized cards are associated with and is returned in the JWT.

4) If card holder is registered (Card holder’s second time making a payment):

- The payment page will display all previously registered cards for the cardholder, with pre-populated fields containing their card details (retrieved from the Adumo Online database).

- The card holder is asked for their CVV if required by the merchant (last 3 digits on the back of the card).

- The card holder selects to "Pay Now" at which stage Adumo Online processes the transaction and the card holder is debited.

- The results of the transaction are posted back to the website.

5) If card holder is registered and wants to modify their details:

- The payment page will display all previously registered cards for the card holder, with pre- populated fields containing their card details (retrieved from the Adumo Online database).

- The card holder chooses a card and selects to "Edit".

- The card holder is then asked for their updated card details.

- The card holder selects "Pay Now" where an update is done on their card details. This updates Adumo Online's database to the new card details the card holder entered.

- The transaction is processed to the bank.

- The results of the transaction are posted back to website.

6) If card holder is registered and the card has expired:

- The card holder is displayed a message informing them that their card has expired.

- The card holder is forced to update their card details and are prompted for updated card details.

- The card holder selects "Pay Now" and the card details are updated.

- The transaction is processed and the card holder is debited.

- The results of the transaction are posted back to website.

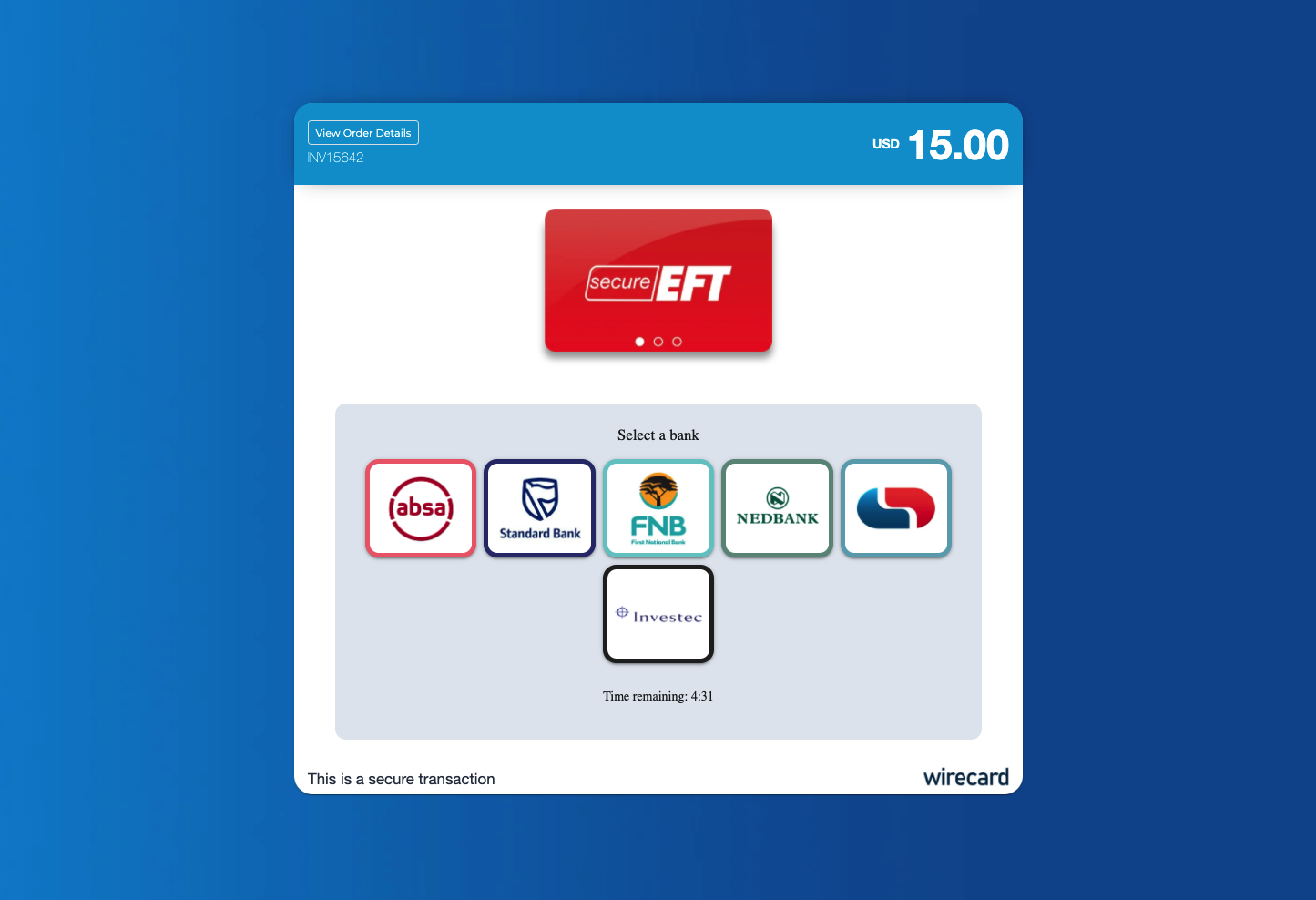

SecureEFT

SecureEFT is a streamlined version of a traditional EFT. It makes payment of a bank transfer a lot faster and easier by eliminating certain steps such as creating a beneficiary, entering the reference number and amount or provide a proof of payment. SecureEFT only requires a buyer to login to their bank account and authenticate the payment through the banks one time pin or authentication methodology.

SecureEFT Transaction Process

Step 1 - The customer selects the SecureEFT payment option

Step 2 - The customer is prompted to select their bank

Step 3 - The customer would sign into there banking profile using there internet banking details

Step 4 - SecureEFT returns the results of the payment to Adumo Online

Step 5 - Adumo Online returns these results to the merchant. The merchant can then display the results on the payment confirmation page

Example of SecureEFT Page